What are the best crypto currencies to buy

The world of Crypto Currency is new, confusing, and full of risks. Many people are hesitant to get involved because they don’t understand it. Others have gotten burned by making bad decisions, so they stay away.

But there are many good reasons to consider investing in crypto currency…

And if you do your own research, you can find some really good opportunities out there!

Here are a few things to look for when you’re doing your research:

The Must-Have Crypto Research Tools for Beginner Investors

1. Total Locked Value (TVL) – Defi Llama

Total Locked Value (TVL) is a metric used to measure the total dollar value of crypto assets deposited on a blockchain, decentralized application, or specific project. It is useful for beginner investors as it helps to give a snapshot of the performance of a cryptocurrency, by providing financial metrics such as total revenue and price to earnings ratio. This can help investors determine whether a cryptocurrency is undervalued or overvalued compared to others within the same sector.

Cointree offers advanced trading charts with technical indicators to help users identify exciting trading opportunities. These charts come with built-in technical indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD) and Moving Average, to provide a detailed look at the market.

3. Messari

Messari is an essential cryptocurrency data aggregator and research tool for beginner investors. It offers comprehensive analysis capabilities and helps you make better trading decisions through its built-in screener with a variety of filters like volatility, volume, liquidity and market cap. The Messari screener is particularly useful for uncovering hidden gems and potential gains. It also provides a variety of community-created screeners to narrow down the best options, like those from major funds such as Coinbase and Alameda Research. Messari Pro is the premium version of the tool, costing $24.99 a month paid annually or $29.00 a month with no minimum subscription.

4. Trading Platforms

For those looking to get started with cryptocurrency trading, the best crypto trading platforms for beginners are Coinigy, Tradedash, HaasOnline, and Gekko. These platforms offer near real-time, accurate information regarding price action, circulating supply, total supply, and more. The user-friendly features of platforms like Coinigy and Tradedash make them ideal for those just getting started with buying cryptocurrency. Coinigy also supports 45+ exchanges, trading charts, and quality support.

5. CryptoMiso

CryptoMiso is a must-have crypto research tool for beginner investors, allowing them to analyze the development of any cryptocurrency project, giving them an edge in their decision-making when investing. CryptoMiso gathers and ranks cryptocurrencies based on activity on Github, letting users see the exact number of commits made and how many contributors are working on the protocol. Additionally, users can visualize how the commits are changing over time. This is an important insight that investors must consider when investing in cryptocurrencies, as a lack of development could mean the project is dead. With CryptoMiso, beginner investors can easily track the development of any cryptocurrency, helping them make more informed investment decisions.

6. Charting Tools

For beginner investors, there are a few charting tools that can help with technical analysis and understanding the market. TradingView is a great tool for charting and visualizing different trading indicators and drawing trend lines. It offers both free and premium functionalities and has several technical indicators available. Cryptowat.ch is another great tool for charting, with 10+ charts available in one view. Coin Metrics is another great tool for cryptocurrency financial intelligence and market data, with over 100 assets and 400+ metrics. Finally, portfolio trackers are incredibly useful for keeping a pulse on your portfolio and checking the value of your investments.

7. Price Comparison

Price comparison is a process of comparing the prices of similar products or services from different providers. It is an important step for beginner investors, as it helps them to identify the best deals and make informed decisions that can lead to a successful investment.

Price comparison helps investors to save money, as they can identify the most cost-effective options for the same product or service. Furthermore, it facilitates a better understanding of the market and its dynamics. By analyzing and comparing prices, investors can make a more informed decision about the asset they are investing in and the risk and reward associated with it.

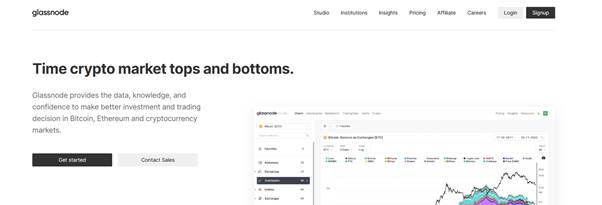

8. Glassnode

Glassnode is an on-chain data and intelligence platform that provides investors with metrics and insights based on blockchain data. It offers free access to “Tier 1” data, which is updated every 24 hours, as well as paid subscription options with additional tiers of data and more frequent updates.

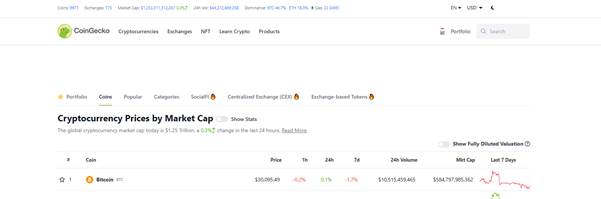

9. CoinGecko

CoinGecko is a data aggregator and crypto market analysis website that tracks cryptocurrency prices by market capitalization and provides a comprehensive analysis of the crypto market. It is useful for beginner investors as it provides an extensive library of guides and other educational material, in-depth analysis of the crypto market, and useful features such as the ability to view live price changes for cryptocurrencies and exchanges, and create and track their own portfolios.

10. Santiment

Santiment is a crypto research tool that helps beginner investors better understand the crypto market. It provides on-chain, social media and financial data on almost 2,000 cryptocurrencies, allowing investors to gain insights into the price movements of any crypto. The platform also offers fundamental insights and behavioral reports to keep users informed of imminent developments. In addition, the platform offers essential metrics with a 30-day lag, which is useful for learning what the metrics are and how to use them. For those looking for more comprehensive data, Santiment has two subscription plans: Pro for $44 a month and Pro+ for $225 a month.

The platform also features Sanbase Studio, which is a great tool for studying individual cryptos.

11. News Aggregators

News aggregators are platforms that are designed to help investors keep track of the latest news and events related to the cryptocurrency market. They provide an easy-to-use overview of the most important news stories and events, allowing novice investors to quickly and easily stay informed.

By providing a single source of information, news aggregators make it easy for investors to identify potential opportunities and risks associated with their investments. Investors can use news aggregators to monitor news and events related to the cryptocurrency market and make informed investment decisions. For example, investors can use aggregators to view price movements, upcoming events, and bearish or bullish signals that could influence their decisions.

12. Financial Metrics

Financial metrics are important to beginner investors because they can provide valuable insights into the health of a project or digital asset. For example, a cryptocurrency’s social media and community channel numbers can be an indicator of its popularity. Similarly, assets’ price, market capitalization, circulating supply, total supply, daily active users, token holder distribution, and 24-hour trading volume provide an overview of the asset’s performance. Tokenomics, which outlines how tokens are distributed and incentivized, can also be evaluated. Finally, block explorers and on-chain data aggregators such as Glassnode and IntoTheBlock can provide additional information about asset metrics.

13. CoinMarketCap

CoinMarketCap is an essential tool for beginner cryptocurrency investors, as it provides reliable and up-to-date information on the price, market cap, volume, and supply of coins. It is a widely used and trusted source for cryptocurrency market data, as it provides investors with insights on the current market movements and trends.

14. Coinbase One

Coinbase One is a premium trading service for individuals that is still in beta and available to a limited number of users. It offers a range of benefits to users, including $0 trading fees, special rates for staking yielding assets, 24/7 phone support, and a 90-day free trial to Messari Pro. Coinbase One is an excellent tool for beginner investors as it offers a low commission rate of 0.05 percent and no account minimum, so investors can start trading with relatively little capital and reduced risk. Additionally, Coinbase supports a wide range of cryptocurrencies, including Bitcoin, Ethereum, Solana, and Tether, and has a convenient app for making quick transactions in GBP, allowing users to buy and sell digital currencies quickly and easily.

15. Crypto Fear and Greed Index (CFEI)

The Crypto Fear and Greed Index is a tool used by investors and traders to quickly ascertain the current market sentiment. It uses a range of indicators to measure levels of fear and greed in the market, with higher levels of fear typically signaling a correction is due, while extreme levels of greed can indicate the market is overheating. Neutral levels can be a sign it is an opportune time for swing trading.

The index can be a helpful tool for beginner investors to understand the market and make informed decisions. By using the index, investors can get an idea of when to enter or exit a position, as well as identify potential scams.

16. TokenTerminal

TokenTerminal is a platform designed to make it easier for beginner investors to access, analyze, and understand the data and metrics associated with cryptocurrencies. Token Terminal collects financial data from blockchains and decentralized applications and then presents it in easy-to-understand metrics that can give investors an overview of how a cryptocurrency is performing.

17. Visual overview – Coin360

Coin360 is a great tool for beginner crypto investors. It provides a quick visual overview of the current market performance by displaying the total value of cryptocurrency market capitalization, 24hr trading volume, and the top gainers and losers in the market. With the help of filters, users can customize the data according to their preferences such as selecting a specific time period, market cap size, and market sectors.

18. Filter crypto news – CryptoPanic

CryptoPanic is a great tool for filtering crypto news because it allows you to customize your own dashboard for price alerts, filter news by bullish/bearish sentiment, media type, and recency, search coins to see all related events, and receive the most important crypto news directly to your inbox.

19. Daily Bytes – Cointree

Cointree is a leading crypto trading platform that offers beginners and more experienced investors a range of tools to help them make informed decisions when trading crypto. It provides a free portfolio tracker which tracks portfolio performance in Australian dollars and makes it easy to manage investments. With Cointree, users can track 24h price changes, project highlights, the latest crypto news, and more.

20. Developer activity – CryptoMiso

CryptoMiso is a cryptocurrency research tool that helps beginner investors keep track of the development of particular crypto projects. It ranks coins according to their activity on Github, giving you a better understanding of how a crypto project is progressing. It shows the exact number of commits made to a project, how many contributors are working on the protocol, and how the commits are changing over time. This is important to understand since cryptocurrencies are software protocols that can die if not developed, maintained and improved. CryptoMiso also provides insights such as median fee costs per transaction, hashrate, and other technical information that is important to understand the health of a project.

21. Cardano (ADA)

The key research tools for Cardano (ADA) include: extensive experimentation, peer-reviewed research, 120+ papers on blockchain technology, Ouroboros Hydra for scalability, Transactions Per Second (TPS) simulations, proof of stake consensus mechanism, GitHub development, loyalty of the Cardano community, interoperability with Ethereum via Milkomeda sidechain, and maxis and marketing.

22. Social signals – LunarCrush

LunarCrush is a social intelligence platform that provides real-time insight into the sentiment of crypto investors and traders. By monitoring millions of social media posts, LunarCrush is able to provide investors with valuable data, such as social volume, social engagement, and social dominance. These metrics can help investors to identify trends and make better-informed decisions. For example, an increase in bullish sentiment could indicate an upcoming increase in price and provide an opportunity for investors to buy.

For beginner investors, LunarCrush can be a valuable tool. It provides easy-to-understand metrics which can help identify potential trading opportunities. Additionally, LunarCrush has its own token, lunr, that can be used to unlock perks and rewards. This can be a great way for beginner investors to get their feet wet in the crypto world, without having to invest too much money.

However, it is important for beginner investors to understand that there is always a risk of losing money in crypto investments. Despite LunarCrush providing valuable data and insights, it is important to do your own research, be aware of potential scams, and understand the market before making any decisions.

What are the best crypto currencies to buy?

1. Bitcoin

Bitcoin is one of the best crypto currencies to buy due to its long-term staying power, market dominance, and continued importance to the cryptocurrency ecosystem. Bitcoin has been around since 2009 and has experienced impressive growth and adoption throughout the years, pushing its market share up to 65% of all crypto assets in 2021 and reaching an all-time high of $69,000. It has also outperformed both gold and the S&P 500 for the past three years, and continues to be supported by its devoted followers, known as Bitcoin maximalists. Bitcoin is also a safe, secure, and reliable form of digital money, making it an attractive option for those looking to invest in cryptocurrency. With its high liquidity and low fees, Bitcoin is a smart choice for those looking to add to their crypto portfolio.

2. Ethereum

Ethereum is a great cryptocurrency to buy for a variety of reasons. Firstly, it is the second-largest digital currency by market capitalization after Bitcoin which makes it a more accessible entry point for investors who are looking to explore the world of cryptocurrency. Secondly, Ethereum recently completed its transition to the Proof-of-Stake (PoS) validation method, making it more energy efficient and allowing it to scale better. In addition, Ethereum is home to the Ethereum Virtual Machine (EVM) which empowers developers to build DeFi applications, scale web3, and launch NFT projects. Finally, Ethereum is a great investment option due to its strong token correlation with the scale of the network, meaning its price is expected to increase as more dApps and projects are launched on the network.

3. Ripple

Ripple is a great cryptocurrency to buy due to its low transaction costs, high speeds, scalability (1,500 tps), carbon neutrality, and decentralized exchange (DEX). The low transaction costs and high speeds make Ripple an ideal choice for those looking to make micropayments quickly and with minimal fees. Additionally, Ripple’s scalability allows it to process a large number of transactions with ease and its carbon neutrality makes it an attractive choice for those who are looking to reduce their impact on the environment.

4. Bitcoin Cash

Bitcoin Cash is a good cryptocurrency to buy for those looking for a reliable, secure, and long-term digital asset. Bitcoin Cash has been around for about 11 years, which makes it one of the most trusted and established digital currencies in the space. It also has a strong user base and has a large market cap. What makes Bitcoin Cash unique is that it is a fork of Bitcoin, which means it has all of the same features and technology as Bitcoin, but with additional benefits. Bitcoin Cash allows for faster transaction speeds, lower transaction fees, and better scalability than Bitcoin. It also has a fixed supply, which means it is a deflationary asset and will not be affected by inflation.

5. Litecoin

Litecoin is a great choice for cryptocurrency investors looking for a reliable, low-cost digital currency. It has many of the same features as Bitcoin, such as being decentralized, secure, and immutable, but it has been able to innovate faster, allowing it to offer faster payments and more transactions per second. This makes it an attractive option for people who need to move assets quickly or for those looking to make smaller purchases. Litecoin is also widely accepted and has been endorsed by many users as a reliable and secure digital currency. Finally, Litecoin’s low cost makes it an attractive investment for those on a budget.

6. Cardano

Cardano (ADA) is a great cryptocurrency to buy due to its numerous advantages. First, Cardano was created with a scientific, research-driven approach, with the team behind it writing more than 120 papers on blockchain technology. This level of research and development is unparalleled in the cryptocurrency space, and sets Cardano up for success.

Second, Cardano is also an “Ouroboros proof-of-stake” cryptocurrency, which is much more efficient than the proof-of-work consensus models adopted by other popular cryptocurrencies. The project recently released their Alonzo upgrade, which brings smart contract capabilities to the network. This, coupled with its low transaction costs, makes Cardano a viable network for a wide range of applications.

Third, Cardano has strong developer engagement and a loyal community. The total number of ADA wallets has now hit 3.5 million, and its cross-chain interoperability with Ethereum is a major plus. Finally, its low price point of under $1.25 per piece makes Cardano an attractive investment.

7. IOTA

IOTA is a good cryptocurrency to buy for a variety of reasons. First of all, it is technologically ambitious and is designed for long-term scale, which suggests that its creators are focused on solving a problem rather than making money.

Second, its trading prices are low in comparison to better-known tokens, so it could be a good investment for those who believe in its potential. Third, it has a limited supply and is highly divisible, which makes it attractive to both investors and users. Finally, it has low transaction costs and fast transaction speeds, making it an attractive option for those looking for an efficient way to transfer funds. All in all, IOTA is a great cryptocurrency to consider buying due to its strong potential and attractive features.

8. NEM

NEM is one of the most popular cryptocurrencies and is a great choice for investors looking for both a long-term and short-term investment. It is secure, reliable, and cost-effective, and it has a wide range of features such as a Proof-of-Importance algorithm, a built-in decentralized exchange, and a unique blockchain platform.

Furthermore, its low transaction fees, lightning-fast transactions, and low energy consumption make it a great choice for investors looking to make the most of their investments. NEM is also a great choice for users who want to diversify their portfolios, as NEM has a wide range of tokens and projects to choose from. Finally, NEM is a great choice for those who want to get involved in the world of cryptocurrencies and blockchain technology, as it offers easy-to-follow tutorials and resources.

9. Ethereum Classic

Ethereum Classic (ETC) is an ideal cryptocurrency to buy due to its long-standing trustworthiness and security. ETC is a fork of the original Ethereum blockchain, with the original blockchain code unaltered, and has been running since 2015. As one of the oldest blockchains, Ethereum Classic is a tried and true option that is often seen as a reliable investment. Additionally, Ethereum Classic is a developing platform that has experienced upgrades to its protocol, including the move to a proof-of-stake (PoS) validation method, that have enabled developers to create secure and efficient dApps and projects, and investors to participate in decentralized finance (DeFi) and non-fungible token (NFT) markets.

10. Polkadot

Polkadot (DOT) is a unique PoS cryptocurrency that offers an unprecedented level of interoperability between blockchains. This is possible thanks to the Polkadot relay chain, which enables different networks to communicate and interact with one another. Furthermore, Polkadot allows users to create their own blockchains with the added security provided by Polkadot’s chain, which is especially beneficial for smaller projects that would otherwise be open to attack. This concept of shared security is what sets Polkadot apart from Ethereum.

How to do your own research on cryptocurrencies?

Step 1: Choose your cryptocurrency

Choosing the right cryptocurrency to invest in can be a daunting task. But with some research and due diligence, you can make an informed decision. Here is a step-by-step guide to help you choose your cryptocurrency:

Step 1: Choose a Platform. First, decide which platform to use.

Step 2: Fund Your Account.

Step 3: Place an Order.

Step 4: Research Cryptocurrencies.

Step 2: Research platforms and exchanges

Researching platforms and exchanges for cryptocurrencies requires a few steps.

To begin, identify the platform or exchange you’d like to research. Check for general information, such as the project’s website and white paper. Additionally, consider what cryptocurrencies are on offer, the fees charged, security features, storage and withdrawal options, and any educational resources.

Step 3: Research strategies and indicators

When researching cryptocurrencies, it is important to use a variety of strategies and indicators to get a comprehensive understanding of the project.

Google search strings such as “crypto in [industry]” and “crypto [market] use case” should be used to identify competing projects. This will help to understand the competitive advantage of the project, as well as its weaknesses.

Step 4: Research guides and tutorials

What are guides and tutorials for doing research on cryptocurrencies? [Expanded list]:

1. Read through the project’s website and whitepaper. This is the best place to start as it will provide you with the primary information you need to know.

2. Check different sources such as news websites, analysts and other businesses to get a broader perspective.

3. Follow crypto industry experts on social media and read their blog posts and articles.

4. Use research tools such as Glassnode, CoinGecko, Messari, CoinMarketCap, Coin Metrics, Lunar Crush, Santiment, Coinglass (formerly Bybt), Coin Dance and CryptoQuant to get a better understanding of the crypto project.

5. Take into account other people’s opinions and reviews.

6. Check crypto rating websites and look for ratings from reputable sources.

7. Look for press releases, which usually contain important updates about the project.

8. Read the project’s FAQs for more detailed information.

9. Participate in forums and subreddits related to the project.

10. Monitor key metrics such as market capitalization and transaction volume.

11. Keep an eye on the project’s roadmap to track its progress and development.

Step 5: Read analysis articles and reviews

Reading analysis articles and reviews can help you with your cryptocurrency research by providing you with a deeper insight into the project. By reading analysis articles and reviews, you can gain insight into the opinions of various experts, including the developers, analysts, and other businesses. Furthermore, analysis articles and reviews provide a comprehensive look into the project, including fundamental analysis, technical analysis, and opinions on the past, current, and future market.

Step 6: Check market data for each cryptocurrency

Start by researching the cryptocurrency project you are interested in. Check out the project’s website and whitepaper to find out more about the project, its team members, and the competition.

Use Google search strings such as “crypto in [industry]” and “crypto [market] use case” to find out if there are any competitors and to compare the project you are researching with the competition.

Check out some of the best crypto apps to see what bonuses, $0 commissions, and other

Step 7: Research relevant crypto signals platforms like Messari or LunarCrush

Researching relevant crypto signals platforms like Messari or LunarCrush can help you with your research on cryptocurrencies by providing real-time insight into who the social influencers are and tracking the coins, exchanges and influencers that interest you most. These platforms allow you to monitor the sentiment of millions of crypto investors and traders in real-time, separating the signal from the noise and providing you with data and analysis tools to better understand the influence of sentiment on crypto markets. With this data, you can build your own wealth and optimize your investments.

Step 8: Check out portfolio trackers like Cointree or Token Terminal for users starting out with smaller balances

Portfolio trackers like Cointree and Token Terminal are great tools to help users with smaller balances better understand and manage their investments. Here’s a step-by-step guide on how to use these services:

1. Create a free account with Cointree or Token Terminal.

2. Use the portfolio tracker to get an overview of your portfolio in Australian dollars, track your performance over time and compare your overall performance to specific assets.

3. For Cointree, use the platform to quickly make a trade in seconds.

4. For Token Terminal, use the platform to collect the financial data from blockchains and decentralized applications, then view them in easy-to-understand financial metrics to get an overview of how a cryptocurrency is performing.

5. Use the top portfolio section to find hidden gems, diversify your crypto holdings, compare the performance of your own portfolio, and look for an app with additional features such as a fiat cash account and a debit card for spending.

Step 9: Learn about different trading platforms like Binance, Bitfinex or OKCoin etc.

Binance is one of the most popular cryptocurrency trading platforms. It offers a wide range of coins, including Bitcoin, Ethereum, Litecoin, and Ripple. The platform is fast, secure, and easy to use, making it perfect for both beginners and experienced traders alike. Binance also offers low trading fees and a wide variety of trading options, including margin trading and futures. In addition, Binance offers a range of educational resources, including tutorials, webinars, and a comprehensive library of crypto tools.

The Rebels Revolt Ecosystem is a groundbreaking platform that is set to revolutionize multiple industries. With its token-gated applications and services, it offers a range of innovative features and tools designed to empower individuals and businesses.

At the heart of the Rebels Revolt Ecosystem lies its token-gating strategy, which serves as a catalyst for industry disruption. This strategy provides organizations and individuals with the opportunity to seize new possibilities and achieve their goals. To support this strategy, the ecosystem incorporates various applications, including freelance marketplaces, NFT minting studios, influencer marketing platforms, and blockchain launchpads.

A significant aspect of the ecosystem is the Community Platform & Learning Hub, which acts as a thriving social networking site. This platform offers tools for project management and discussion rooms, fostering collaboration among members. Users can participate in projects, receive rewards, and even invest in micro businesses. Furthermore, the Learning Hub provides valuable courses on the digital economy, covering topics such as online commerce, social media marketing, productivity, and contemporary financial practices.

Step 10: Compare coins, check ratings and other metrics

Comparing cryptocurrencies and checking their ratings and other metrics can be done in several ways. First, it is important to research the projects and their technology. This can be done through various sources such as news, reviews, and other articles. Once research is completed, it is time to compare the projects.

FAQs

What are the best cryptocurrencies to buy?

The question of which are the best cryptocurrencies to buy is a difficult one to answer, as the market is ever-changing and different cryptos have different advantages and disadvantages. While Bitcoin is often seen as the original and most popular option, Ethereum is a close second, and it has been growing in popularity since its launch in 2015. There are also other promising cryptocurrencies such as Bitcoin Cash, Litecoin, Cardano, and Avalanche that have been gaining traction in the market.

What is the cryptocurrency market like?

The cryptocurrency market is made up of thousands of different digital assets, with the most popular and widely used being Bitcoin. Bitcoin has been around since 2009 and currently has the highest market cap and value of any other cryptocurrency. Other major players in the cryptocurrency market are Ethereum, Namecoin, Tether, Binance Coin, Litecoin, Ripple, Tezos, Cardano, and Dogecoin. All of these assets are highly speculative and carry a high degree of risk, so it is important to research any investment before deciding to purchase any of these digital assets.

What are the most popular crypto exchanges?

The most popular crypto exchanges are Binance, Coinbase Pro, and BitMEX. Binance is the largest and most popular cryptocurrency exchange with $76 billion in 24h trading volume, 600+ cryptocurrencies to choose from, 90 million registered users, and some of the lowest transaction fees. Coinbase Pro is well trusted, especially by larger investors and is US based and FDIC insured. BitMEX offers high risk, high reward with up to 100x leverage, is Hong Kong based and has never been hacked. Crypto exchanges offer a platform for buyers and sellers to exchange digital currencies such as bitcoin (BTC) and ethereum (ETH).

What are some good research sites for cryptocurrencies?

When it comes to researching cryptocurrencies, there are many good research sites available. For eligible beginners, Coinbase One offers free subscriptions for 30 days and Messari Pro for 90 days. If you’re not eligible, CoinGecko’s free version is a great way to get started. For experienced investors, Messari or Coin Metrics are fantastic for analysis and provide extensive tools. Other good research sites for cryptocurrencies include CoinMarketCal, Coin Metrics, LunarCrush, Santiment, Coinglass (formerly Bybt), Coin Dance, and CryptoQuant. Each of these sites offers valuable insight into the cryptocurrency market and can help you make more informed decisions when it comes to investing.

What is the difference between a token and a coin?

Tokens and coins are two different digital assets that can be used to represent value. Tokens are typically created by a blockchain project or protocol, while coins are a form of digital currency. Tokens can represent a variety of different things, including a stake in a project or a share of the profits. Coins, on the other hand, are typically used as a medium of exchange and are created to be a form of digital currency.

Coins, on the other hand, are typically used as a digital currency and can be bought and sold on exchanges or sent directly to a contract.

How do I find the current price of a cryptocurrency?

1. Visit a cryptocurrency tracking website such as CoinMarketCap or CoinGecko. These platforms provide an overview of the current market and a list of the top cryptocurrencies.

2. Select the cryptocurrency you want to check the price of. You will be able to see its current price, as well as its market cap, volume, and other metrics.

3. If you’re planning to buy, you’ll need to find a platform that you can use to make the purchase. Popular exchanges include Coinbase, Coinbase Pro, and PayPal.

4. Connect a payment method to the exchange and enter the amount of the cryptocurrency you want to buy. The current rate of the cryptocurrency will be reflected in the exchange.

5. You can also use research tools such as Messari, Glassnode, LunarCrush, Coin Metrics, Santiment, CoinGecko, CoinMarketCal, Coin Dance, CryptoMiso, and Coinbase One to track the performance of different cryptocurrencies and get an in-depth analysis of the crypto market.

What is the best cryptocurrency trading platform?

When it comes to cryptocurrency trading, finding the best platform for your needs can be a daunting task. There are a variety of platforms available, each with its own set of features and fees. To make the best choice for your trading, you need to compare the different options and evaluate their features and fees.

Coinigy is one of the most popular platforms, offering 45+ exchanges, trading charts, and quality support. It has a user-friendly interface and allows for easy transfer of funds. Coinigy also offers historical data for purchase, allowing developers to experiment with their own trading strategies.

Tradedash is also a popular trading platform, supporting both Bittrex and Binance. It is a desktop application, meaning users’ private keys are encrypted and stored on their own machines for additional security.

When choosing the best crypto trading platform, it’s important to consider not just the features, but also the fees, market capitalization, past performance, market value, volatility and taxes. Automated trading bots can also help you maximize your profits while staying safe. Whichever platform you choose, make sure it offers both low fees and strong security features.

What are the risks of investing in cryptocurrencies?

Investing in cryptocurrencies carries with it a number of risks. These include the possibility of the value plummeting, losing track of the asset, or having it stolen by cybercriminals. The lack of centralisation also means that if you are the victim of fraud, you may have difficulty getting your money back.

In addition to these risks, there is also the risk of volatility. Cryptocurrency markets are highly volatile and you can expect to see dramatic swings in prices on a regular basis. Therefore, if your investment portfolio or mental wellbeing can’t handle this, cryptocurrency may not be a wise choice for you.

Finally, it’s also important to research exchanges and know how to store your digital currency securely before investing. There are many different exchanges to choose from and different kinds of wallets with varying benefits, technical requirements, and security.

What are the fees associated with trading cryptocurrencies?

The fees associated with trading cryptocurrencies vary greatly. Coinbase has a steep commission structure, charging a spread markup of around 0.5 percent and adding a transaction fee based on the size of the transaction and the funding source. On the other hand, Binance has a more competitive fee structure, offering trading fees starting at 0.45 percent of the transaction value or less, depending on your 30-day trading volume. TradeStation Crypto offers commission-based pricing to traders, with pricing ranging from 0.025 percent of an order to 0.6 percent, and offers volume trading discounts.

What are the best tools for researching cryptocurrencies?

When it comes to researching cryptocurrencies, it is important to be informed and to practice due diligence. Investing in cryptos is like investing in any other asset class and requires knowledge and understanding of the market. The best tools for researching cryptocurrencies are CoinGecko, Messari, CoinMarketCal, Coin Metrics, LunarCrush, Santiment, Coinglass (Former Bybt), Coin Dance, CryptoQuant, and Glassnode. These tools are designed to help crypto investors stay informed, reduce risk, and make the most informed decisions. By using these tools, investors can research a crypto project to understand what it does, who is behind it, and how it compares with other projects. Additionally, these tools provide insights into the price movements of any crypto project, helping investors stay ahead of the game.